does colorado have a solar tax credit

Some states have state. The federal solar tax credit.

Solar Panel Incentives Rebates Tax Credits A Definitive Guide

Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that.

. On top of these great Colorado rebates and exemptions you also qualify for the sizable tax credit from the Federal government. Colorado state sales tax exemption for solar power systems though the state tax credit is no longer an option for colorado customers solar power systems are exempt from related sales and use taxes. Colorado Solar Power Performance Payments Performance-Based Incentives.

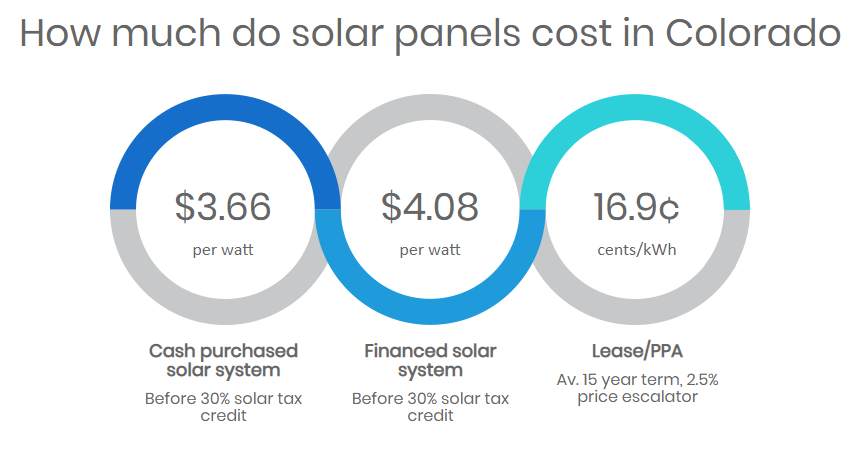

Colorado Solar Rebates Incentives and Tax Credits Colorado is definitely one of the more progressive states out there when it comes to renewable energy generation. You may use the Departments free e-file service Revenue Online to file your state income tax. 12720 Approximate system cost in Colorado after the 26 ITC in 2021.

Save time and file online. Does Colorado Have A Solar Tax Credit - Commercial solar pv systems are required to derive a minimum of 75 of their power from solar on a sliding scale to be eligible. 6 Approximate average-sized 5-kilowatt kW system cost in Colorado.

For example a commercial. While Colorado is a leader in solar energy the state itself does not offer any tax credit on solar energy. This perk is commonly known as the ITC short for Investment Tax Credit.

This federal tax credit is available to colorado homeowners and provides a 26 tax credit of the entire solar system cost including a battery system. Throughout the US residential solar energy systems are eligible for several lucrative financial incentives. Cost of Installation X 30 Tax Credit.

Summary of solar rebates available to Colorado residents. Whos The Top Solar Company. Colorado Solar Energy Systems Eligible for Tax Exemptions.

Dont forget about federal solar incentives. Pay no sales tax in Colorado on the purchase and installation of a solar energy system. San Miguel Power Association.

Note that because reducing state income taxes increases federal income taxes paid the two tax credits are not additive ie not 25 26 51. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent. And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22.

Colorado does not offer state solar tax credits. 30 off system price through 2019. Colorado state sales tax exemption for solar power systems though the state tax credit is no longer an option for colorado customers solar power systems are exempt from related sales and use taxes.

Compare 1000s Of Reviews Ratings From Actual Customers. Find Details Online For Colorado. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives including net metering programs and state tax incentives.

In 2004 Colorado passed a ballot initiative creating a state-wide Renewable Energy Portfolio Standard RPS that has paved the way for the expansion of the Colorado solar industry. The residential ITC drops to 22 in 2023 and ends in 2024. While the State of Colorado no longer offers tax credits for residential solar the federal government still provides a 30 Investment Tax Credit for home solar power systems.

You do not need to login to Revenue Online to File a Return. You can claim the credit for your primary residence vacation home and for either an existing structure or new construction. See Ratings Compare.

Established by The Energy Policy Act of 2005 the federal tax credit for residential energy property initially applied to solar-electric systems solar water heating systems and fuel cells. Dont Forget the Federal Tax Credit Colorado. The federal solar tax credit along with state and local grants rebates and tax credits can add up to savings of more than 50 percent on a home photovoltaic system.

Federal solar investment tax credit. The Energy Improvement and Extension Act of 2008 extended the tax credit to small wind-energy systems and geothermal heat pumps effective January 1 2008. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Colorado. One reason for this might be that there are many rebates and grants elsewhere through local governments and utility companies. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online.

To calculate the PV systems AC output a de-rating factor is used to account for shading and suboptimal orientation or tilt. So even though your home value will certainly increase after solar installation you wont have to pay for it in taxes. Roaring Fork Valley and Crystal River Valley.

Homeowners who installed solar in 2020 were eligible. Colorado Property Tax Exemption for Solar The Property Tax Exemption for Residential Renewable Energy Equipment ensures that your new solar system isnt included in property tax assessments. 026 1 022 025 455.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Total energy bill savings 100 electric bill offset. For an 18000 system the total cost.

Through its Renewable Energy Rebate Program Colorado Springs Utilities CSU offers a rebate to customers who install grid-connected solar-electric photovoltaic or PV systems. Ad Get 2022 Solar Company Quotes Information. You can take the total cost of your solar system installation and apply 30 to your tax liability for the year.

Ad Find The Best Solar Providers In Colorado. Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit. Xcel Energy offers the top utility net metering program in Colorado.

Enter Your Zip Find Out How Much You Might Save. Colorado government solar tax credit.

Federal Solar Tax Credit How It Works Explained In Plain English Sun Source Homes

Solar Tax Credit 2021 Extension What You Need To Know Energysage

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

Solar Tax Credits And Rebates Grand Junction Colorado

How To Apply For A Rebate On Your Solar Panels Reenergizeco

What Tax Deductions Can I Claim For Installing Solar Panels In Colorado

Colorado Solar Incentives Five Things Residents Need To Know Ion Solar

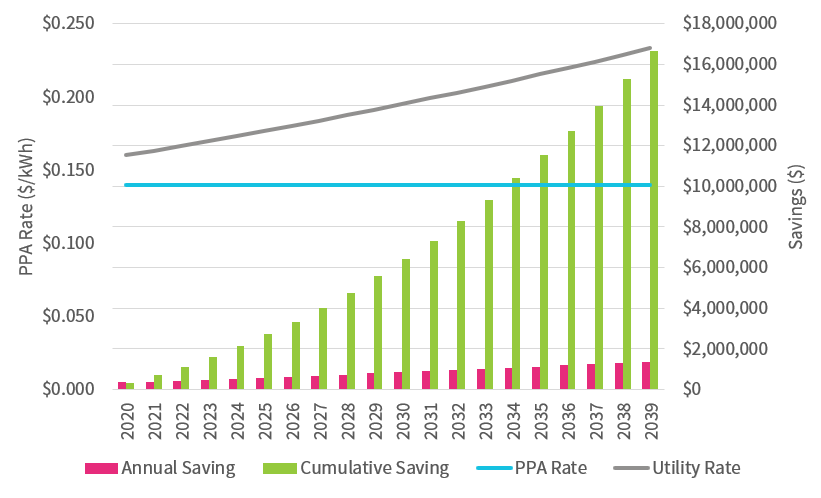

Time S Running Out Why Public Institutions Should Act Quickly To Maximize Solar Tax Credits Forefront Power

When Does The Federal Solar Tax Credit Expire Iws

Is Solar Worth It In Colorado Colorado Solar Panels 2021 Solar Website

The Extended 26 Solar Tax Credit Critical Factors To Know

Texas Solar Panels Texas Solar Company Sunpro Solar

Solar Is It Worth It Living Colorado Springs

Colorado Solar Information Solar Energy Facts

Colorado Solar Panel Installation Costs 2022 Solar Metric

![]()

Solar Tax Credits 2020 Blue Raven Solar

Tax Credits Archives Ion Solar

Will The Solar Tax Credit Apply To Battery Storage Systems Cam Solar